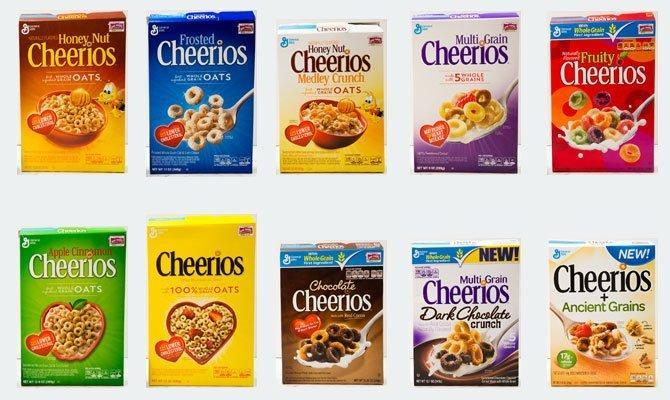

When I was a kid, there were two varieties of Cheerios, one version of Listerine, and one type of Crest toothpaste. If you got to the supermarket these days, there are about a dozen varieties of Cheerios, more than a half dozen versions of Listerines, and so many varieties of Crest that your head can spin. The bottom line: there is always something for you to buy.

If you’re a plan sponsor, there are so many things for you to buy. Plan sponsors need the services of plan providers, an ERISA bond, and fiduciary liability insurance. The problem is that many times, plan sponsors are being sold services that they don’t really need and the plan sponsors are really unaware of it unless they have an ERISA attorney or trusted plan advisor helping them.

For example, I had a client with a 30-year-old sharing plan. The bulk of the assets were in an insurance policy that the owner/sole participant bought on the advice of the insurance salesperson/plan advisor. The owner wanted to terminate the plan and transfer the insurance policy to himself at distribution. The insurance policy had been paid up for years, so what did another insurance salesperson try to do? He tried to sell the owner a new insurance policy for a company that is about extinct and where the owner is around 70. Thankfully, this owner had an ERISA attorney (cough, cough) and a third party administrator who knew what’s best for the client.

The point is that plan sponsors have money and there will always be plan providers willing to take that money especially those that are a little unscrupulous and selling plan sponsors stuff that they don’t need.

If you’re being sold something, make sure it’s something you need as a plan sponsor.