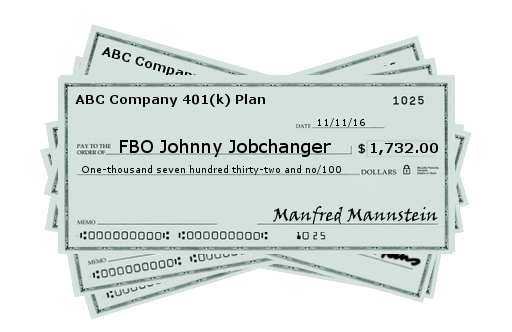

In a recent revenue ruling, the IRS stated that if a participant or a beneficiary doesn’t cash a distribution check in the year it was issued, the individual still must include the amount in gross income for that year. Also, if any withholding is required on the distribution, the issuer must withhold and report for the year in which the distribution is made, regardless of whether the check is cashed in the same year. Also, the 1099-R is issued for the year of distribution and must reflect the distribution amount and amount withheld. While it’s guidance, I don’t think it’s much as its consistent with the rule of constructive receipt.

The problem is that the IRS didn’t take the time to provide any clear guidance about what to do when a distribution involves a missing or lost participant. The IRS punted and stated that it’s still analyzing the missing participant issue. Presumably, this means that if a check is returned to a plan as undeliverable this IRS guidance doesn’t apply.