I talk to a lot of advisors and I have many advisor clients around the country and one of the things that I keep on hearing is that even with fee disclosure regulations almost 5 years later, it ‘s still difficult to get through to plan sponsors about their fiduciary responsibility as plan fiduciaries.

Having been a pessimist for a good chunk of my life, I see things now as the glass being half full. That means over the past several years, plan sponsors are more educated as a whole when it comes to plan expenses and fiduciary responsibility.

Companies like Brightscope have done a great job of bringing fee benchmarking and disclosure to the forefront for plan sponsors to understand why they need to care about fees and their investment options. The proliferation in the hiring of outside ERISA fiduciaries also proves that point.

So while many plan sponsors now “get it” when it comes to fiduciary responsibility, there will always be that group that don’t. They say they cover all their bases and how they are in good hands with their current providers even though they made absolutely no fee benchmarking or due diligence. They say that big participant lawsuits like Tibble and Tussey don’t matter to them because their plans are small. I learned a long time ago that there are probably still folks out there that think the earth is flat and there is no use in getting aggravated because their time will come when they see that light. There is no guarantee they will see the light, but these plan sponsors will only understand it when they get sued by their plan participants or when the Department of Labor starts auditing them and figuring out what they did with their fee disclosure and whether they documented their fiduciary process. Some people will never get it until some type of plan litigation goes against them or someone they know.

Fee disclosure has had a tremendous impact and the regulations have teeth. Making plan sponsors suffer the consequences of a prohibited transaction for not complying with the fee disclosure regulations will awaken the stubborn plan sponsors who shrug off their fiduciary responsibility.

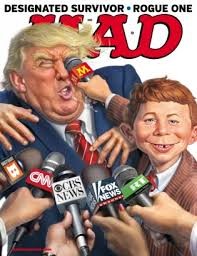

My great grandmother said it best, don’t run after the carriage if it’s not going to pick you up which means that if you are a plan provider, that don’t bother with the plan sponsors who listen to your proposition concerning fiduciary responsibility and shrug their soldiers and give the old Alfred E. Neuman :what me worry?” line. If there is any luck, they will get it when it’s too late.