In light of some troubling news that a third party administrator (TPA) was shut down by the Federal Bureau of Investigation (FBI) for possible theft of plan assets, there is one pro-active step you should take as a plan sponsor and it’s really simple.

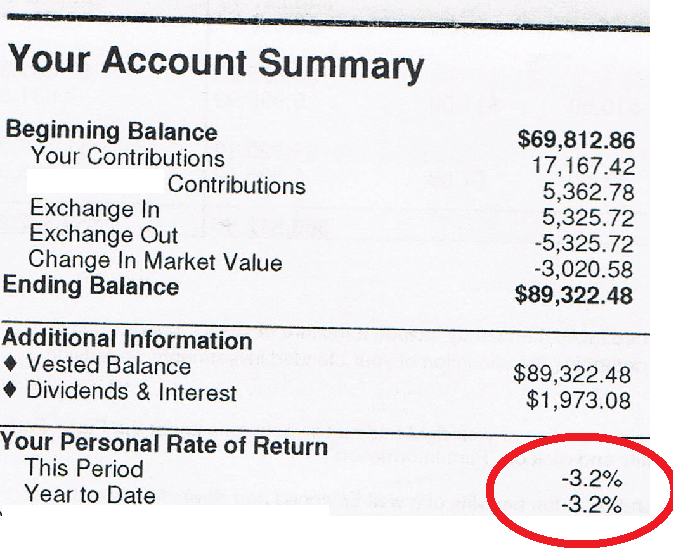

When it comes to plan theft, you can’t guard your plan’s assets like putting an alarm on your car or putting a guard to stand outside a bank. What you can do is to actually review your plan’s trust statements and identify any unusually large plan withdrawals that can’t be attributed to participant payouts. As long as the plan assets are held by a reputable custodian like Fidelity, Schwab, Empower, Mass Mutual, Vanguard, and any other well-known investment institution, you can make sure that the statements will be accurate when it comes to mass withdrawals. My client who had their assets where Bernie Madoff was the custodian was out of luck.

You can’t eliminate the threat of theft, but you can make moves to minimize the risk. So review those trust statements when received and make sure the ERISA bond is up to date as well as your fiduciary liability insurance. If you see any suspicious activity in your trust statements, say something.