One aspect of the SECURE Act that many commentators failure to note is that it’s mor expensive to file a late Form 5500.

The Internal Revenue Service (IRS) penalty before the SECURE Act was $25 a day, up to a maximum penalty of $15,000 per plan year. The SECURE Act has increased the IRS penalty to$250 a day, up to a maximum penalty of $150,000 per plan year.

The Department of Labor’s (DOL) fees are even higher with the penalty for a late filer being $2,194 per day (adjusted for inflation for penalties assessed after January 23, 2019), with no maximum.

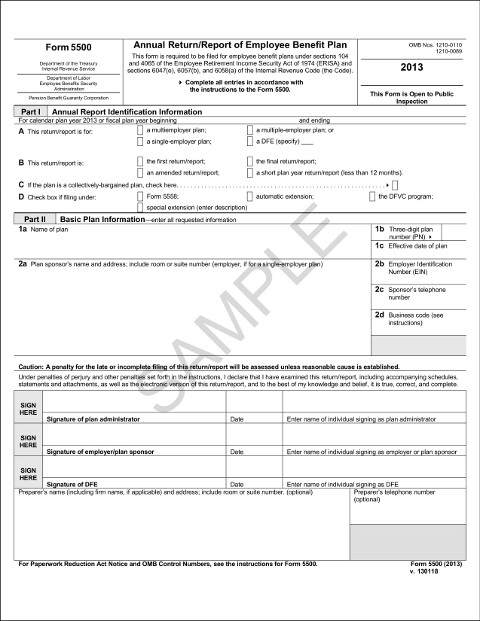

To be eligible to reduce these potential penalties through the DOL’s Delinquent Filer Voluntary Compliance Program (DFVCP), you will have to file the application as a plan sponsor. If the plan is under IRS or DOL audit, you are going to find yourself no longer eligible for the DFVCP.