As many of you know, I offer a Retirement Plan Tune-Up, a legal review for $750 that reviews the documentation, administration, costs, and the fiduciary process of a retirement plan.

Regardless of whether you would use my review or hire someone else, it is incumbent on plan sponsors as plan fiduciaries to review their plan on an annual basis to see whether the plan still fits their needs and whether it’s running correctly. Running correctly is about paying reasonable fees, taking care of the fiduciary process, and making sure the plan is operating correctly according to its terms and the law.

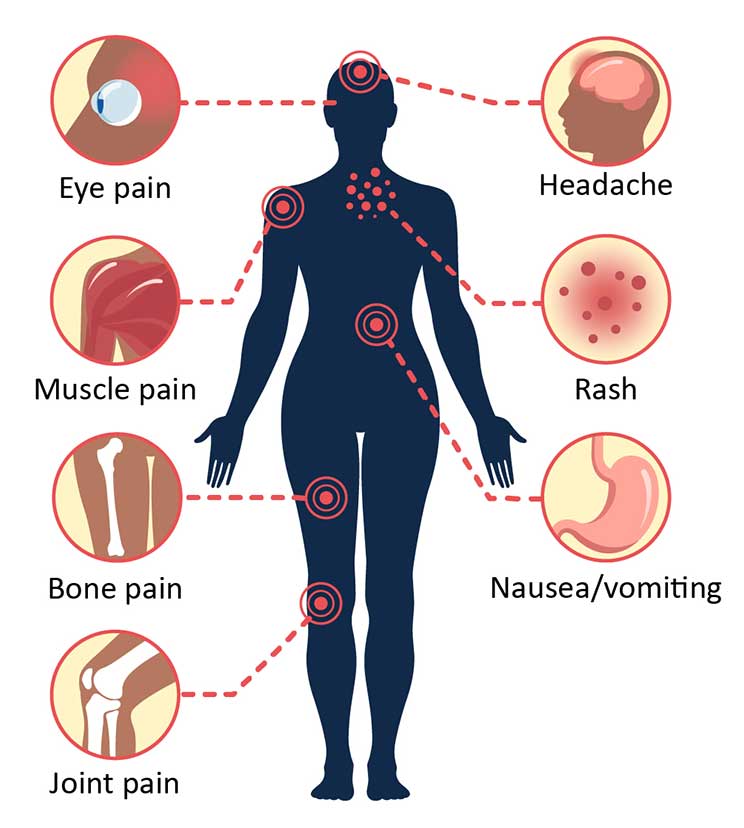

So while all plans should be reviewed, there are some plans with more glaring problems than others. These plans may have symptoms that the plan isn’t running correctly and should immediately undergo a plan review.

- A plan where the third-party administrator is not fully transparent on fees, especially when it comes to indirect payments they receive, such as revenue sharing payments from mutual funds.

- A company that has a profit-sharing and money purchase plan that covers the same group of employees.

- A plan that has consistently failed their discrimination testing, whether it’s the tests for salary deferrals, top-heavy, match, or 410(b) participation.

- A defined benefit plan that is underfunded.

- A defined benefit plan for a company that has increased its workforce.

- Any plan with no financial advisor.

- A money purchase plan that is covering non-collectively bargained employees.

- Any 401(k) plan that has not reviewed their contract with their insurance company provider in the last 5 years.

- Any plan without an investment policy statement.

- Any plan that has not reviewed their choice of investments in the last year.

- Any plan that has not seen their financial advisor in the last year.

- Any plan without an ERISA bond and/or fiduciary liability insurance.

- A 401(k) plan with low participation or low average account balance per participant.

- Any plan that has not been updated in the last 2-3 years.

These are just some examples of symptoms that indicate you may have a retirement plan in distress. Regardless of whether you have the symptoms or not, you should have your plan reviewed.