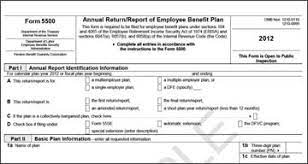

With the initial 5500 deadline coming and going and October 15th around the corner, it makes sense for you to realize what happens if you fail to file our Form 5500 on time, with or without an extension. You might be late because the audit isn’t done or you didn’t provide the information to the third-party administrator.

If you are late, that Form 5500 needs to be filed coincident with an application to the Department of Labor’s Delinquent Filer Voluntary Compliance Program that allows you to file the form late and pay a nominal fee. Otherwise, you may get a bill from the Department of Labor and/or the Internal Revenue Service that you owe thousands in penalties.