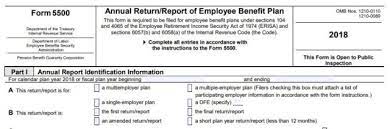

The Department of Labor (DOL) announced changes to Form 5500.

For Multiple Employer Plans (MEPs), new codes have been added to Line 8a of Part II to identify different types of MEPs, such as pooled employer plans, association retirement plans, professional employer organization MEPs, and other MEPs.

For Schedule MB, used by multiemployer defined benefit plans and certain money-purchase plan actuarial information, instructions for Line 3 have been changed to require an attachment that shows total withdrawal liability payments by participating employers, made to the plan while separating periodic and lump sum withdrawals. Line 8b(1) was updated to increase the projection period in the attachment to 50 years for plans with 1,000 or more participants. Line 8b(3) has been changed to require plans with 1,000 or more participants to attach a 10-year projection of employer contributions and withdrawals. Schedule R, Line 13 of Part V was changed to require plans must report identifying information about any participating employer who either contributed more than 5% of the plan’s total contributions or was one of the 10 highest contributors.

The instructions for Form 5500, have been updated to reflect an increase in the maximum civil penalty amount assessable under ERISA.