State-run retirement programs, including automatic individual retirement accounts (IRAs), are expanding access to retirement savings, with total assets nearing $2 billion. However, a new study from the Georgetown University Center for Retirement Initiatives (CRI) highlights that significant access gaps remain, as 47% of U.S. private sector workers—around 59 million individuals—lack access to employer-sponsored retirement savings plans.

The study reveals that access to retirement plans varies by employer size, with smaller firms being the least likely to offer coverage. Nationally, the Georgetown CRI estimates that 63% of private sector workers at small firms—those with fewer than 50 employees—do not have access to workplace retirement savings, compared to only 34% at larger firms. Furthermore, an additional 23.4 million gig economy workers also lack access to employer-sponsored retirement plans.

The Georgetown CRI argues that state-facilitated auto-IRA programs can help bridge these gaps by requiring private employers to provide access to state programs for employees who would otherwise have no workplace-linked retirement savings options. Previous research has indicated that state retirement program mandates can encourage firms in those states to establish their own retirement savings plans.

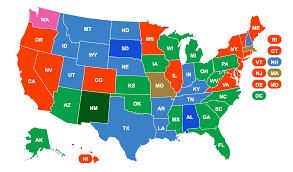

Currently, state-facilitated programs have been adopted in 20 states and potentially could provide coverage for approximately 20.6 million workers in those states who currently lack access.

Among U.S. states, Florida has the highest percentage of private sector workers—59%, or about 4.97 million employees—who lack access to employer-sponsored retirement plans. Additionally, 2.33 million gig workers in Florida also face this lack of access, and 73% of small business employees in the state do not have workplace retirement options.