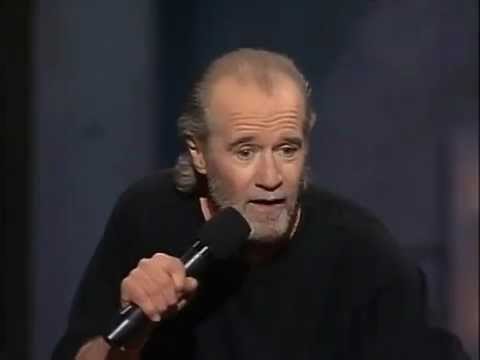

My favorite comedian was George Carlin and George had a great act on euphemisms and how toilet paper became bathroom tissue and how a used car became a pre-owned automobile. All George was saying that euphemisms can cloud meanings of words and confuse people.

Of course, the retirement plan industry has euphemisms and loves to package simple products into some intricate wrapping and make it sound more important than it really is or denotes that this product offered by countless plan providers is somehow exclusive.

I was at a conference once and a third party administrator was touting their proprietary volume submitter retirement plan document with special allocation groups with a group for each employee. A colleague asked me about this unique proprietary plan and I told him what it really was, a 401(k) plan with a new comparability formula. There is nothing unique about is as countless ERISA attorneys and TPAs offer these plan documents.

I remember a former TPA competitor touting a retirement plan that was specifically tailored for medical practices and law firms. All they were really offering was a cash balance plan that was participant directed (before the cash balance regulations disallowed it).

We, of course, have bundled providers offering fiduciary warranties that sometimes aren’t worth the paper it’s written on and we have several plan providers touting their co-fiduciary services which kind of reminds me when my mother was touting how well my brother in law folded clothes, so what?

Plan sponsors should concentrate more on substance than on flash and if they love flash, understand whether what the plan provider offering is actually unique or something no different from what every other plan provider is offering.