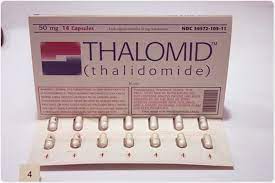

Thalidomide was supposed to be the wonder drug that helped women manage morning sickness until they discovered it caused birth defects. Asbestos was supposed to be the ultimate fire-resistant material that was later found to cause mesothelioma when produced or when disturbed. When companies decided to ditch defined benefit pension plans for a cheaper alternative in the 401(k) plan, they also had a hidden danger with a 401(k) plan, but it doesn’t have to be that way. If managed correctly, a 401(k) plan is an effective retirement plan for the employer and employees. If not, it’s a retirement plan thalidomide except the plan sponsor doesn’t know the danger.

The switch from defined benefit plans to 401(k) plans switches the burden of funding retirement from the employer to the employee. If the plan is participant-directed, it also switches the selection of investments from employers aided by financial advisors to the folks who have the least amount of background to make these tough decisions, the plan participants. Too many plan sponsors don’t educate their plan participants to make informed investment decisions and too many plan sponsors don’t have a proficient investment advisor to guide them through the financial process. It doesn’t have to be this way. Getting investment advisors who know what they’re doing and getting participants enough investment education/advice isn’t hard, but too many plan sponsors are too lazy to manage. But it doesn’t have to be this way.

Defined benefit plans have pretty straightforward fees. You know how much annual administration is and you don’t have that luxury with participant-directed 401(k) plans that have multiple fees that can confuse anyone including retirement plan professionals. Too many plan sponsors have been sued because the 401(k) plan fees are too high since plan sponsors have a fiduciary to pay reasonable fees. But it doesn’t have to be this way. Plan sponsors can benchmark their fees to see if they are reasonable, actually, they have no choice; they have that duty.

401(k) plans don’t have to be a hidden danger; all they need is a plan sponsor who understands their pitfalls and wants to avoid the liability that goes with it. That’s the tallest order.