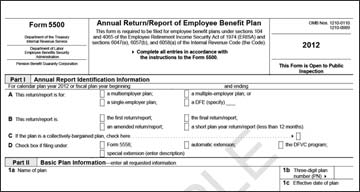

The purpose of an audit of Form 5500 is to make sure that plan sponsors voluntarily comply with the Internal Revenue Code and ERISA. Sometimes, an Internal Revenue Service (IRS) or Department of Labor (DOL) audit is done randomly and you get the unlucky pick when you’re chosen.

However, a good deal of the time, it’s because of an answer you made on Form 5500, a tax form where you answered under penalties of perjury. If you answered that you made late deferrals, don’t have the necessary bond, or committed a prohibited transaction, you may expect that letter within the next 1-3 years. Even if you don’t get audited, a late deferral deposit may get a notice from the DOL that they don’t have an application from you for their Voluntary Fiduciary Compliance Program.